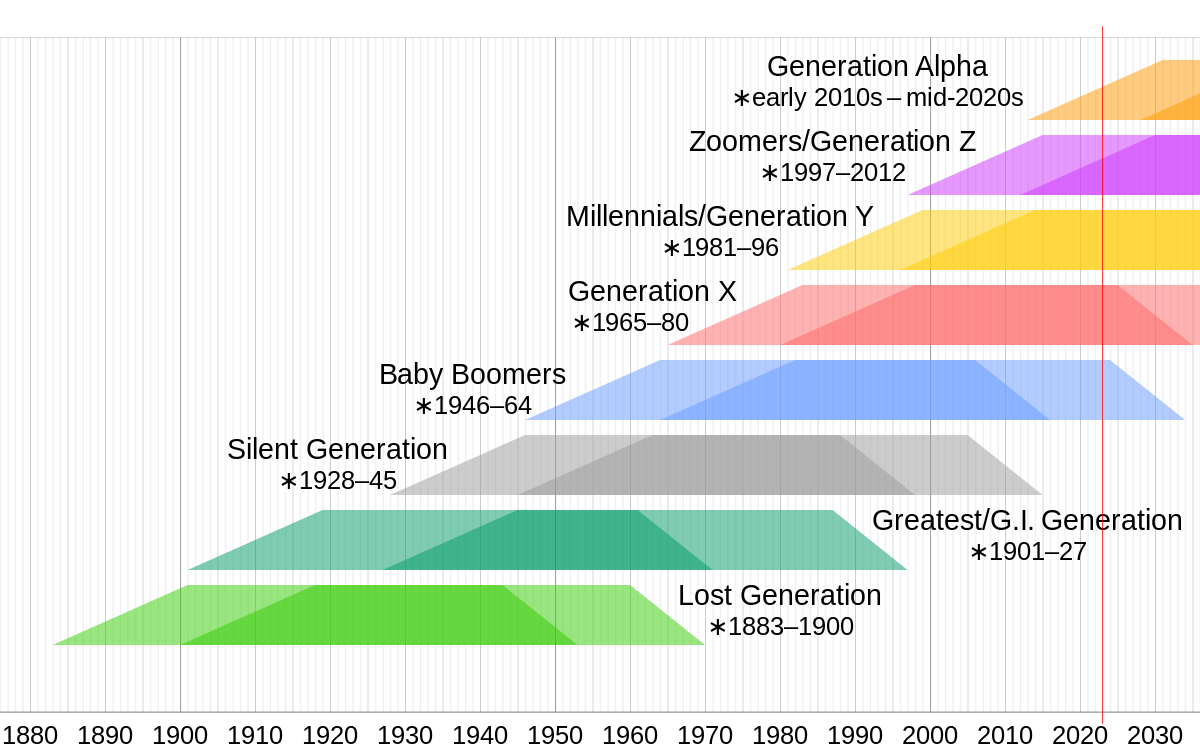

More than 65 million Generation X Americans are facing a huge wealth gap. Generation X who are between 43 and 58 simply won’t have enough to retire.

According to asset management company Schroders’ 2023 US Retirement Survey, Gen X people need more than $1.1 million to retire and most of them expect to have $660,000 saved by the time they hit 67.

A study from the National Institute on Retirement Security (NIRS) found that a typical Gen X household has only $40,000 set aside for retirement.

“The American dream of retirement is going to be a nightmare for too many Gen Xers,” said the executive director of NIRS Dan Doonan.

More than 60% of non-retired Gen Xers say they are not confident in their ability to achieve financial security in retirement compared to 49% of millennials and 53% of baby boomers.

NIRS research director Tyler Bond says that a lot of it is to do with employers.

“Most Gen Xers don’t have a pension plan, they’ve lived through multiple economic crises, wages aren’t keeping up with inflation and costs are rising.

“A big part of the problem is that far too many Gen Xers don’t have access to a retirement plan through their employer. Only 14% of Gen Xers have a pension plan, and only about half are participating in a retirement plan at their job.”

Bond said that without these it becomes very difficult to meet retirement savings targets that will enable them to retire with their current standard of living.

“Accruing savings takes time, and Social Security alone won’t provide enough retirement income. The status quote means we are looking at elder poverty for many Gen Xers and pressure on their families for support.”

On top of everything else the government also announced that it would be cutting benefit funds in 2034. The Old Age and Survivors fund will only pay benefits until 2023.

Read More News