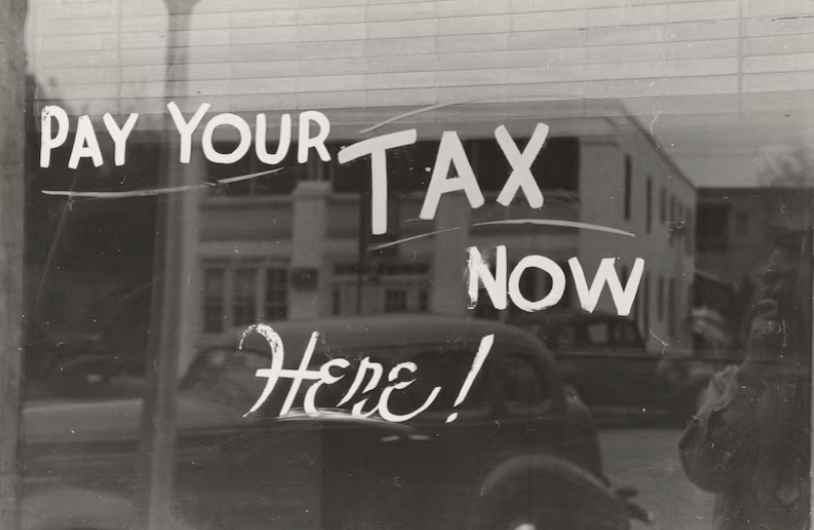

Disney heiress calls for a tax code revamp

One of the biggest advocates of overhauling America’s tax code is Abigail Disney, a Walt Disney heiress to a huge inheritance. Disney who is a filmmaker and philanthropist is not a believer in generational wealth.

She says the tax code preserves a disproportionate share of wealth in America’s high income segment and says that millionaires like herself would be happy to pay more in taxes.

Disney Heiress on Tax

The Disney heiress spoke up on Tax Day which was on April 18, 2023 at an event outside the Capitol Building.

“It’s time to enact a new tax code that drives the benefits of the economy directly into the pocket of working people. It requires those who benefited the most from America’s economic structure to recycle a significant portion of that benefit back into our society rather than allowing them to amass fortunes so large that they threaten our democracy.”

Disney is not the only millionaire campaigning for Congress to implement a stricter wealth tax on high-net worth individuals. The group called Patriotic Millionaires includes Lawrence Lessig, Jeffrey Gural, Roberta Kaplan, Chuck Collins, George Zimmer, Norma Lear and actor Mark Ruffalo. The group was actually founded in 2010.

In a Yahoo finance report, Disney laid out a three-point plan to “strengthen American democratic capitalism” through a revised tax code.

Disney said the plan was to “strengthen American democratic capitalism” through a revised tax code. First, she argued that all income above $1 million should be taxed the same, whether it is earned via paychecks, capital gains, or if it is inherited.

Income Tax Requirements

Second, Disney proposed waiving income tax requirements for those earning below a living wage while hiking marginal tax rates for high earners, claiming that her family’s patriarch, Walt Disney, was able to “amass plenty of wealth” despite paying a marginal tax rate of 90% during his lifetime. Third, she called for a new wealth tax that could “rein in wealth concentration.”

Enjoying this article?

Subscribe to get more stories like this delivered to your inbox.

Abigail Disney has donated $70 million of her personal wealth in the last 30 years. In an op ed published on April 15, the Patriotic Millionaires wrote that the “ultra-rich live in an entirely separate world when it comes to taxes adding that the high levels of inequality fueled by extreme wealth are pushing the economy and democracy to breaking points. The proposal is that for those earning more than $100 million a year, a 90% rate should be implemented.

Read More News

Kim Kardashian serenaded by Usher during concert

Photo above is from Unsplash

Senior Writer