Mark Cuban sounds the alarm: Avoid the glitzy pitfalls of fame—investing in restaurants and fashion is ‘the death’ of your wealth

When celebrities and athletes achieve fame, the next logical step is often to turn that fame into fortune.

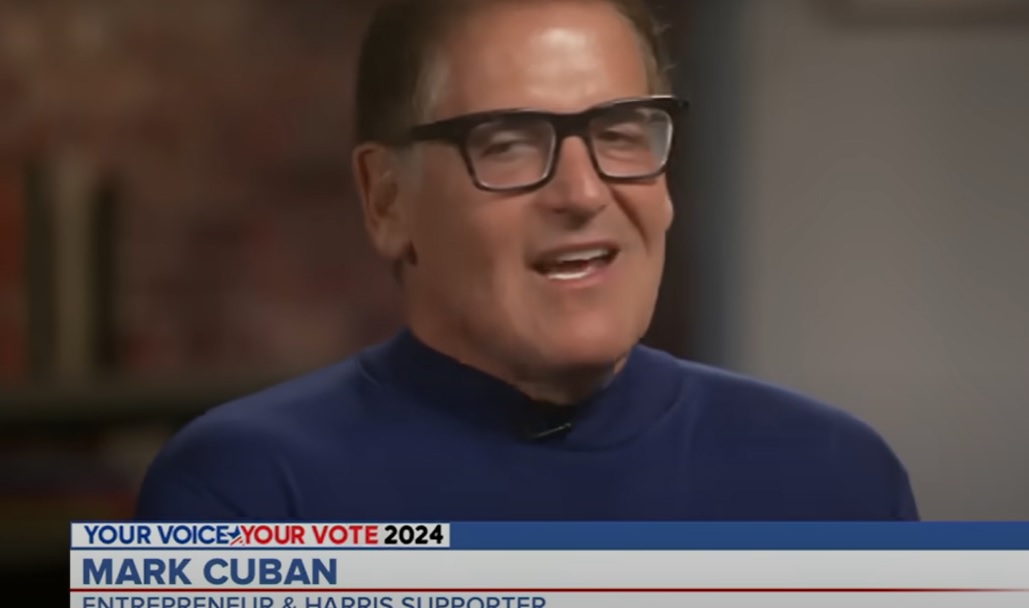

However, featured in a Moneywise report, billionaire investor Mark Cuban warned those looking to invest their newfound wealth. During a recent episode of the “Club Shay Shay” podcast with Shannon Sharpe, Cuban advised against investing in trendy ventures like restaurants, clothing lines, liquor brands, and music labels, declaring, “That is the death!”

Dangers of low barriers to entry

Cuban’s scepticism is rooted in the idea that these industries have minimal barriers to entry. He points out that while it might be easy for anyone to launch a restaurant or a clothing brand, that very ease can lead to fierce competition and diluted profitability.

He challenged Sharpe to name a successful clothing label launched by an athlete, to which Sharpe could not respond. This lack of standout success underscores Cuban’s concerns.

According to the Corporate Finance Institute, barriers to entry—such as regulatory requirements, technology challenges, or strong intellectual property protections—can shield successful companies from competition.

Take the weight-loss drug Ozempic as an example. Developed by pharmaceutical giant Novo Nordisk, this drug represents years of investment in research, regulatory approval, and manufacturing.

The significant resources required mean that few competitors can realistically enter this market, resulting in strong profits for Novo Nordisk since its launch.

In contrast, starting a restaurant or clothing label demands far less investment and expertise. This lack of regulation makes it easy for anyone to jump in, leading to market saturation.

The average profit margin for a full-service restaurant hovers around a mere 3% to 5%, illustrating just how tough it can be to thrive in such a competitive environment.

The key to smart investing

Cuban emphasizes that those with significant capital should seek professional help in managing their investments. “It cannot be your friend,” he stresses. “It’s got to be someone who’s done it for big-time people.”

Enjoying this article?

Subscribe to get more stories like this delivered to your inbox.

This professional guidance can help navigate the complexities of investment decisions and steer clear of ventures that may seem appealing but are fraught with risk.

While the allure of trendy investments may be strong, Cuban’s advice serves as a cautionary tale. Investors should focus on industries with higher barriers to entry and thoroughly evaluate the uniqueness of the product before diving in. With the right approach, they can protect their wealth and make more informed investment choices.

Writer