Get-rich-quick gurus: A no-no for Charlie Munger

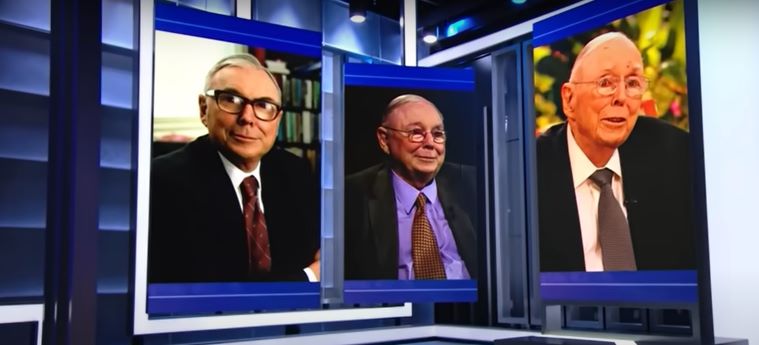

Warren Buffett’s longtime business partner, the late Charlie Munger, was never one to mince words. Whether discussing the nuances of building wealth or his skepticism about cryptocurrency and get-rich-quick schemes, Munger’s blunt and candid style was well-known among shareholders.

At the 2019 Daily Journal shareholders meeting, Munger directed his sharp wit toward a new trend — the rise of day trading influencers. His verdict on social media gurus coaching inexperienced investors to trade stocks was scathing.

“If you take the modern world where people are trying to teach you how to come in and trade actively in stocks, well, I regard that as roughly equivalent to trying to induce a bunch of young people to start off on heroin,” Munger stated. “It is really stupid.”

Get-rich-quick: No-no for Charlie Munger

Munger’s disdain for get-rich-quick schemes highlights a broader issue: financial literacy. According to the 2024 TIAA Institute-GFLEC Personal Finance Index, U.S. adults, on average, correctly answered only 48% of 28 personal finance questions. This statistic has barely improved since the index’s inception in 2017.

One contributing factor is the source of financial advice. A 2023 Forbes Advisor survey revealed that 79% of American millennials and Gen Z have received financial guidance from social media. The platforms prioritize engaging content, often leading influencers to promote their products and services—a business model Munger found deeply troubling.

Critique of get-rich-quick gurus

Munger’s criticism extended to the commercialization of financial advice. He found it absurd that wealthy individuals would further enrich themselves by selling dreams of wealth through trading. “There are people on TV saying, ‘I have this book that will teach you how to make 300% a year, and all you have to do is pay for shipping,’” he told shareholders. “They mislead you on purpose, and I get tired of it. I don’t think it’s right that we deliberately mislead people as much as we do.”

Consequences of bad advice

Munger’s frustration is well-founded. Poor financial advice can have severe, real-world repercussions. He and Buffett have long championed the virtues of passive investing. Buffett often argues that most active investors fail to outperform an index, suggesting that average investors should consider index funds for building wealth. Munger echoed this sentiment, advocating for everyday people to invest in index funds.

No shortcuts

Index funds offer a safer, more reliable path to wealth accumulation for those wary of the high-risk promises of social media financial gurus. The S&P 500, for instance, has historically delivered an average annual return of over 10%, according to the Official Data Foundation. This consistent performance underscores the wisdom of Munger and Buffett’s advice: steady, long-term investment in index funds is often the most prudent strategy for most investors.

Enjoying this article?

Subscribe to get more stories like this delivered to your inbox.

In a world awash with quick-fix financial advice, Munger’s no-nonsense perspective serves as a crucial reminder — when it comes to building wealth, there are no shortcuts.

Source:

Related Stories:

Finance Influencers: The new financial gurus Gen Z?

Wealth guru Warren Buffett reveals 7 things poor people squander money on

Secret to success: ‘Save like a pessimist, invest like an optimist’ – Bill Gates